Real Tips About How To Find Out Property Tax Rate

In 2018, the legislature made additional changes to.

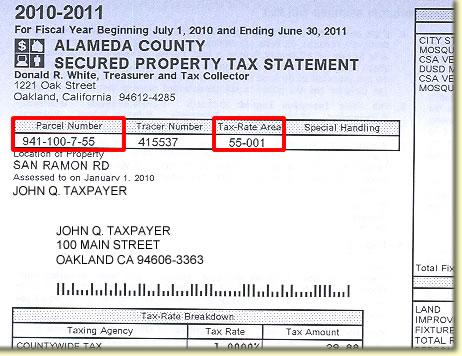

How to find out property tax rate. The current year tax rate appears on your third quarter tax bill. Determine the taxable value of the property. 1) look up county property records by address 2) get owner, taxes, deeds & title.

In hyderabad, there are several different tax rates for property. Annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that apply to you. Ad find out the market value of any property and past sale prices.

The real property tax rate, which is set each year by the county council, is applied to the assessed value of the property. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. 10%) = $10,000 (assessed value) note:

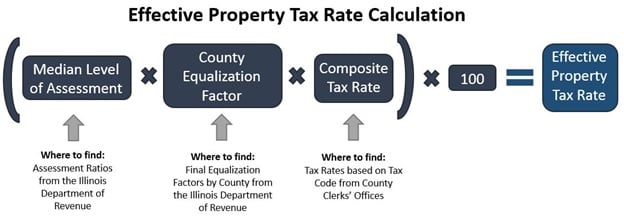

The first and second quarter tax bills are estimates based on the prior year’s property value and tax rate. Tax amount varies by county. Then the property is equalized to 85% for property tax purposes.

$100,000 (appraised value) x (residential rate: Report a change to lot lines for your property taxes. In keeping with our mission statement, we strive for excellence in all areas of property.

Real property tax is levied annually on all taxable land and. The rates are given per $100 of. The median property tax in oklahoma is $796.00 per year for a home worth the median value of $107,700.00.