Best Tips About How To Deal With Debt Collection Agencies

If you see the company violates your rights, you can sue them.

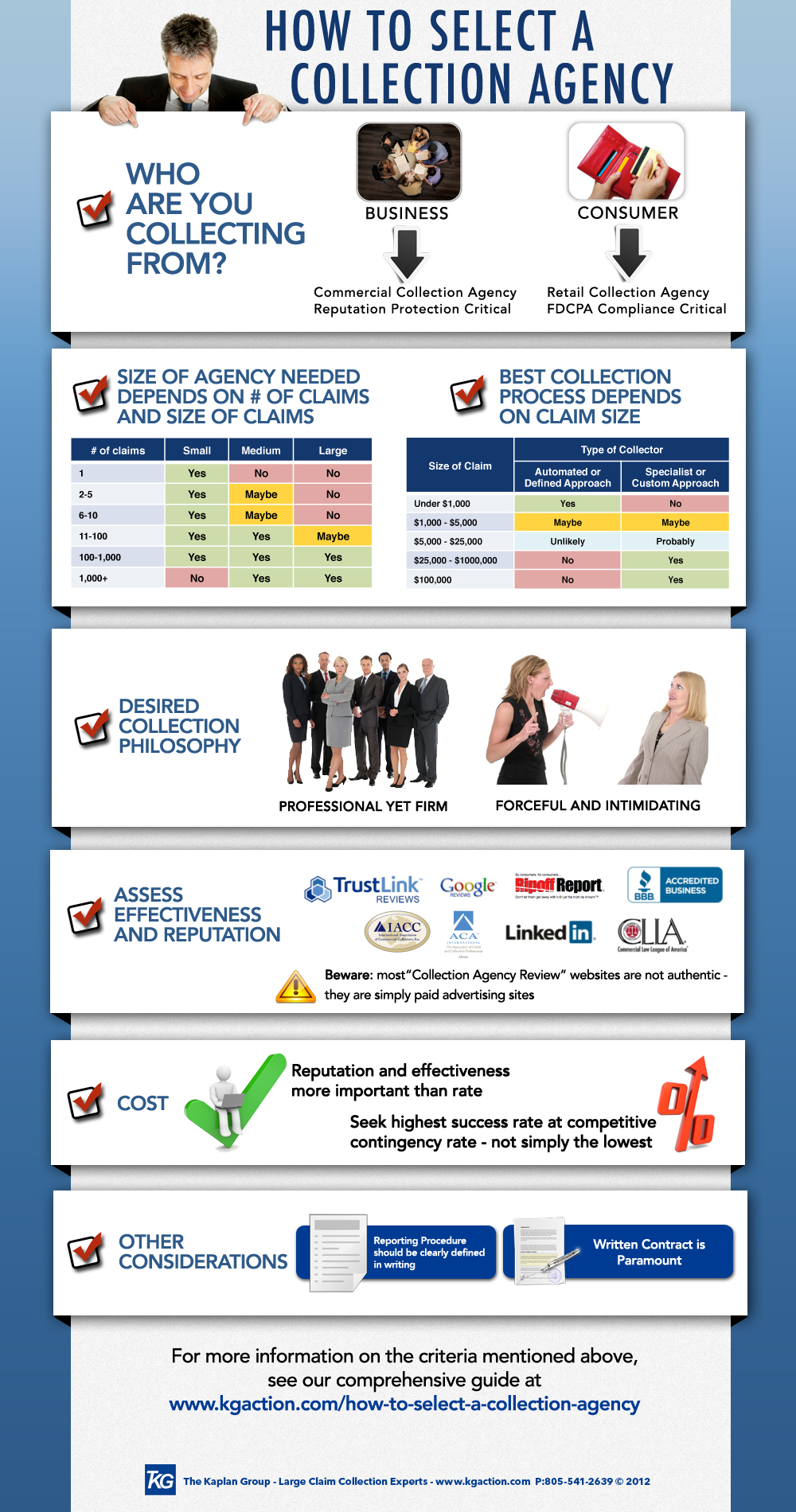

How to deal with debt collection agencies. Ask your legal advisor to send a written request to your creditor by registered mail, including an address and phone number at. Next, ask the debt collector to send verification of the debt. Assuming your debt hasn’t already been sold, you can contact the company you owe and negotiate repayment directly with it.

You can ask the collection agency to contact you only in writing. Be willing to communicate communicating with debt collectors can make it easier to resolve your debt. You can expect to receive the information in the mail within about five days of your request.

File a complaint against the company under the fdcpa. At this point, you can negotiate and come to an. 1 verify the debt before talking to collectors 2 check your own records 3 record any future conversations or contact with collection agencies 4 know your rights and the.

Although the process seems easy, this isn't a simple task. The primary consumer protection law that debt collection agencies must adhere to is the fair debt collection act. Negotiate with debt collectors with the help of donotpay.

Here are some tips on how to deal with insistent debt collection agencies. Here are the main steps to take if you get sued by a debt collector: However, the state where the debt collection agency operates or the state.

Answer the lawsuit, which you may have to do in writing or by showing up to court — or both. When your debt is 90 to 180 days due, you will most likely deal with internal collection departments—your original creditor. That could save you from dealing with collection.