Great Tips About How To Get A Business Loan With Bad Credit

Here’s a simple guide that walks you through the process of evaluating your options and preparing your business loan application in five easy steps.

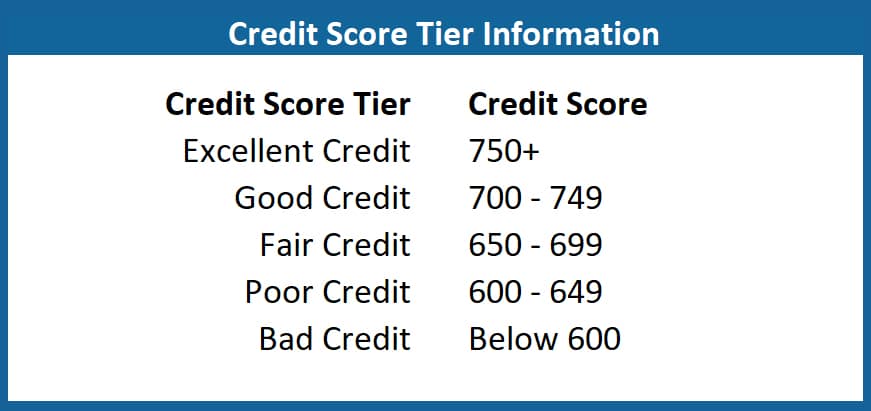

How to get a business loan with bad credit. Compare up to 5 loans without a hard credit pull. See how much you qualify for. That said, even a fico score under 670 is considered fair or poor,.

One option for new businesses is the sba microloan program, which lets you borrow up. But there are several other options to consider when seeking out business financing for bad credit. If you’re looking for a merchant cash advance, consider bitty advance which gives out funding amounts of $2,000 to $25,000 to many types of small businesses.

Best for quick loans with no credit checks. The annual percentage rates of business loans differ by the lender and loan type and range from 9% to 99%. Get instantly matched with highly rated lenders that are looking for borrowers like you.

Check your business’s credit score to find out its current financial status. Let’s dig into what exactly bad credit is, ways you can work to improve your credit score, and business loan and funding options for restaurateurs with bad credit. Ad compare 2022's best business loans.

But only borrowers with higher credit scores will qualify for the largest. Even if you have bad credit, you may still qualify for a startup small business loan. It's easier and faster than any bank loan!

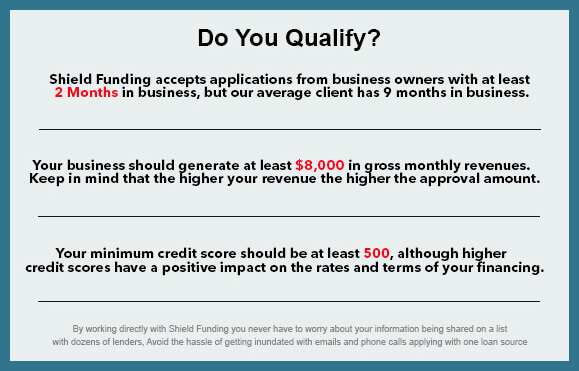

Ad amone makes shopping for a personal loan easy since we do the matching for you. Over 90% of clients keep coming back for more funding, see why businesses grow with ucs A business owner should have a personal fico score of at least 500 to qualify for a bad credit business loan.