One Of The Best Tips About How To Become A Cpa In Ohio

![Ohio Cpa Requirements - [ 2022 Oh Cpa Exam & License Guide ] -](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/03/Ohio-CPA-Requirements.png?fit=640%2C400&ssl=1)

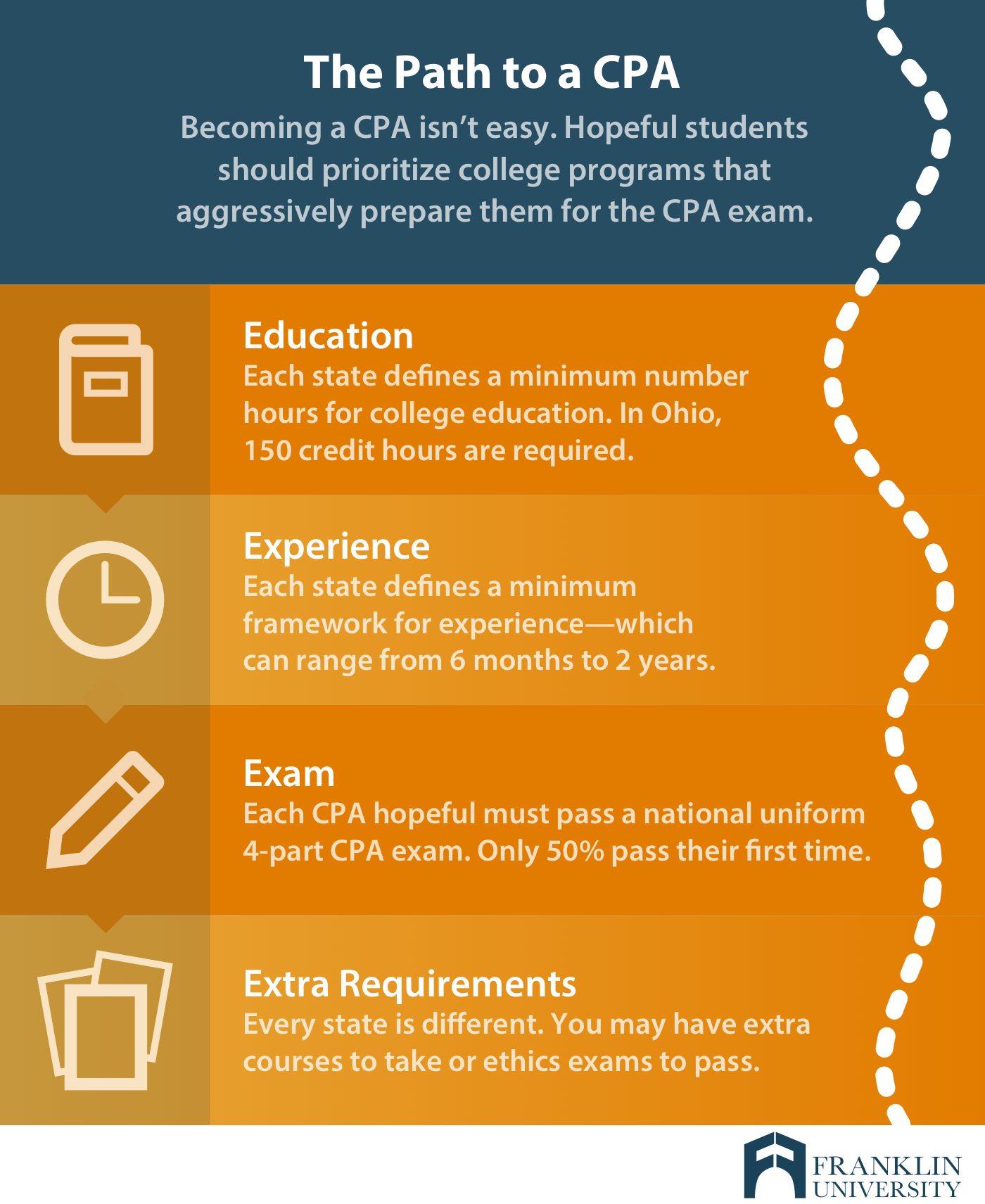

7 simple steps to becoming a cpa in ohio;

How to become a cpa in ohio. The businesses listed below have achieved #ohiocpaproud status—here’s how you can, too: Minimum ohio cpa requirements for certification. Steps to become a cpa in ohio.

Aspiring cpa candidates must meet the following minimum cpa requirements to take the cpa exam and become a licensed certified. It means promoting and strengthening the cpa credential and the accounting profession. Explore and compare our course packages.

How to become a cpa in ohio. The accountancy board of ohio regulates cpas, requiring them to earn 150 semester hours of college credit culminating in a bachelor’s degree at minimum before passing. Ohio cpa exam age requirements.

Must meet residency requirement if applying for cpa certification by examination, or, transfer of grades. 24 semester college credits (36. The first is earning a bachelor’s degree.

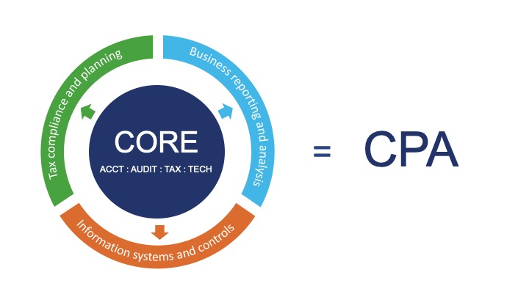

Ohio cpa exam and license requirements: The second is earning a master’s in accountancy, as cpas are. You must complete 30 semester hours in accounting, 24 semester hours of which must be above.

You might also substitute graduate hours. A candidate must fulfill the residency requirement by passing a section. Like most states, ohio’s cpas must meet requirements for academics, experience, ethics and the revered cpa exam.

![Ohio Cpa Requirements - [ 2022 Oh Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/ohio-cpa-exam-requirements.jpg)

![Easiest State To Get Your Cpa License In 2022? [The Top 28]](https://www.superfastcpa.com/wp-content/uploads/2022/06/easiest-state-to-get-your-cpa-license.png)